One limitation of break-even analysis is that it assumes selling prices will stay the same over time. In reality, prices often fluctuate due to market conditions, competition, or changes in demand. For example, if you run a café, you might decide to lower the price of your best-selling drink to attract more customers. While what are taxes this could boost foot traffic, it also means your break-even point will change and you’ll need to sell more drinks to reach profitability. Once you’ve determined your break-even point, you’ll be able easily view how many products you need to sell and how much you’ll need to sell them for in order to be profitable.

Understanding Break-Even Analysis

The amounts and assumptions used in Oil Change Co. are also fictional. $30 is the break-even price for the firm to manufacture 10,000 widgets. The break-even price to manufacture 20,000 widgets is $20 using the same formula. Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others.

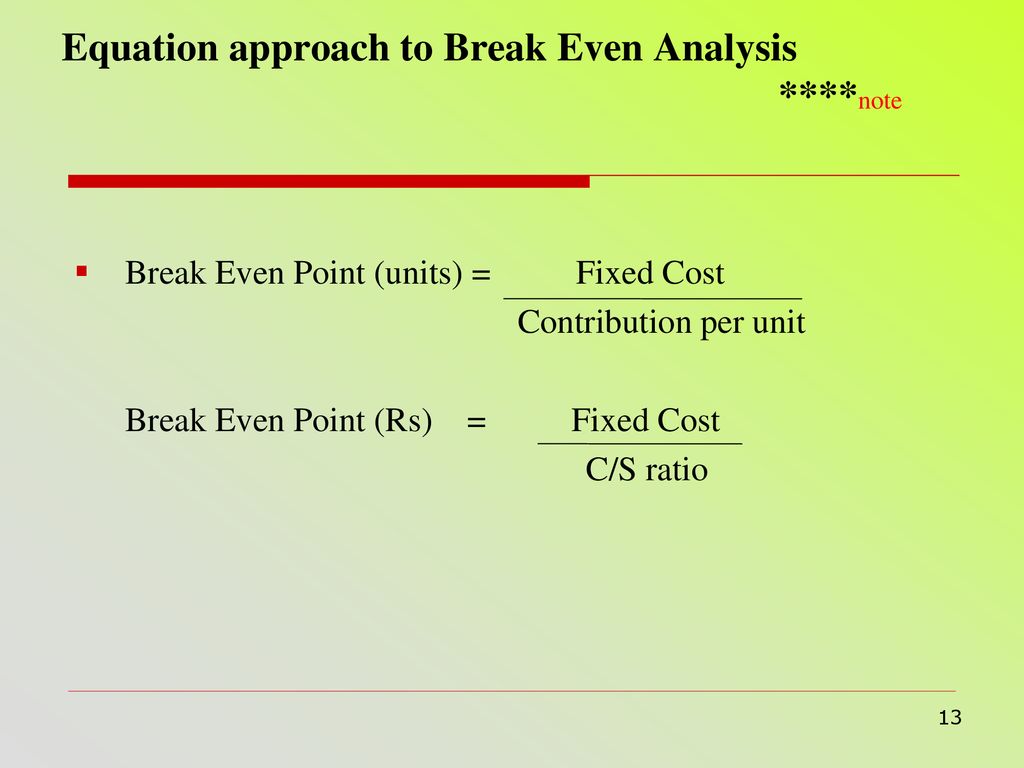

How to calculate a break-even point based on units:

Contact us today to discover what QuickBooks can do to help you with all of your small business accounting needs. When analyzing your break-even point, not only do you want to see that your business is breaking even, you’re looking to make sure your business is profitable as well. Here are a few ways to lower your break-even point and increase your profit margin. Once you’ve decided whether you want to find your break-even point in sales dollars or units, you can then begin your analysis.

Break Even Point Formula and Example

The break-even price covers the cost or initial investment into something. For example, if you sell your house for exactly what you still need to pay, you would leave with zero debt but no profit. Investors who are holding a losing stock position can use an options repair strategy to break even on their investment quickly.

Unit Economics and Cost Structure Assumptions

Typically, an increase in product manufacturing volumes translates to a decrease in break-even prices because costs are spread over more product quantity. At this price, the homeowner would not see any profit, but also would not lose any money. Variable Costs per Unit- Variable costs are costs directly tied to the production of a product, like labor hired to make that product, or materials used. Variable costs often fluctuate, and are typically a company’s largest expense. For example, if the economy is in a recession, your sales might drop.

- An example would be a salesperson’s compensation that is composed of a salary portion (fixed expense) and a commission portion (variable expense).

- The total fixed costs are $50k, and the contribution margin ($) is the difference between the selling price per unit and the variable cost per unit.

- A more advanced break-even analysis calculator would subtract out non-cash expenses from the fixed costs to compute the break-even point cash flow level.

- To make the topic of Break-even Point even easier to understand, we created a collection of premium materials called AccountingCoach PRO.

- Variable Costs per Unit- Variable costs are costs directly tied to the production of a product, like labor hired to make that product, or materials used.

Next, Barbara can translate the number of units into total sales dollars by multiplying the 2,500 units by the total sales price for each unit of $500. If the stock is trading at a market price of $170, for example, the trader has a profit of $6 (breakeven of $176 minus the current market price of $170). At the break-even point, the total cost and selling price are equal, and the firm neither gains nor losses. The break-even point (BEP) helps businesses with pricing decisions, sales forecasting, cost management, and growth strategies. A business would not use break-even analysis to measure its repayment of debt or how long that repayment will take.

However, you need to think about whether your customers would pay $200 for a table, given what your competitors are charging. At the break-even point, you’ve made no profit, but you also haven’t incurred any losses. This metric is important for new businesses to determine if their ideas are viable, as well as for seasoned businesses to identify operational weaknesses.

From this analysis, you can see that if you can reduce the cost variables, you can lower your breakeven point without having to raise your price. Get stock recommendations, portfolio guidance, and more from The Motley Fool’s premium services. Divide 1.03 by 1.01, and subtract one, and the break-even rate of 1.98% represents the average annual inflation rate that would leave the two bonds equal at maturity. Break-even analysis is an important way to help calculate the risks involved in your endeavor and determine whether they’re worthwhile before you invest in the process. Even though break-even analysis can help forge a path to profitability, it’s not a perfect analytical tool. If you find yourself asking these questions, it’s time to perform break-even analysis.

The break-even point or cost-volume-profit relationship can also be examined using graphs. This section provides an overview of the methods that can be applied to calculate the break-even point. It is possible to calculate the break-even point for an entire organization or for the specific projects, initiatives, or activities that an organization undertakes.

Get instant access to video lessons taught by experienced investment bankers. Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts. Or, if using Excel, the break-even point can be calculated using the “Goal Seek” function.

Others ask, “At what point will I be able to draw a fair salary from my company? For example, if you raise the price of a product, you’d have to sell fewer items, but it might be harder to attract buyers. You can lower the price, but would then need to sell more of a product to break even. It can also hint at whether it’s worth using less expensive materials to keep the cost down, or taking out a longer-term business loan to decrease monthly fixed costs. Now Barbara can go back to the board and say that the company must sell at least 2,500 units or the equivalent of $1,250,000 in sales before any profits are realized. As the owner of a small business, you can see that any decision you make about pricing your product, the costs you incur in your business, and sales volume are interrelated.